With the Session Token Swap Program announced and the first ever Session Lab Update dropped, things are progressing quickly with Session Token. Today, new information about the Genesis Distribution is being released.

This post explains what the state of play will be at token generation along with projections for the first few years of Session Token’s existence. There are a lot of moving pieces here, including tokens which are time-locked, tokens which are purpose-locked, and tokens which will be released using the Staking Reward Pool. This post will break down these sometimes-complicated numbers, ensuring you have a clear understanding of Session Token, its future, and what it means for you.

This is a guide for our future plans, but flexibility and adaptability are required for success — and so sometimes things might need to change. Nonetheless, strap yourselves in and grab your reading glasses. Let’s crunch some numbers.

TL;DR (but really, please read it):

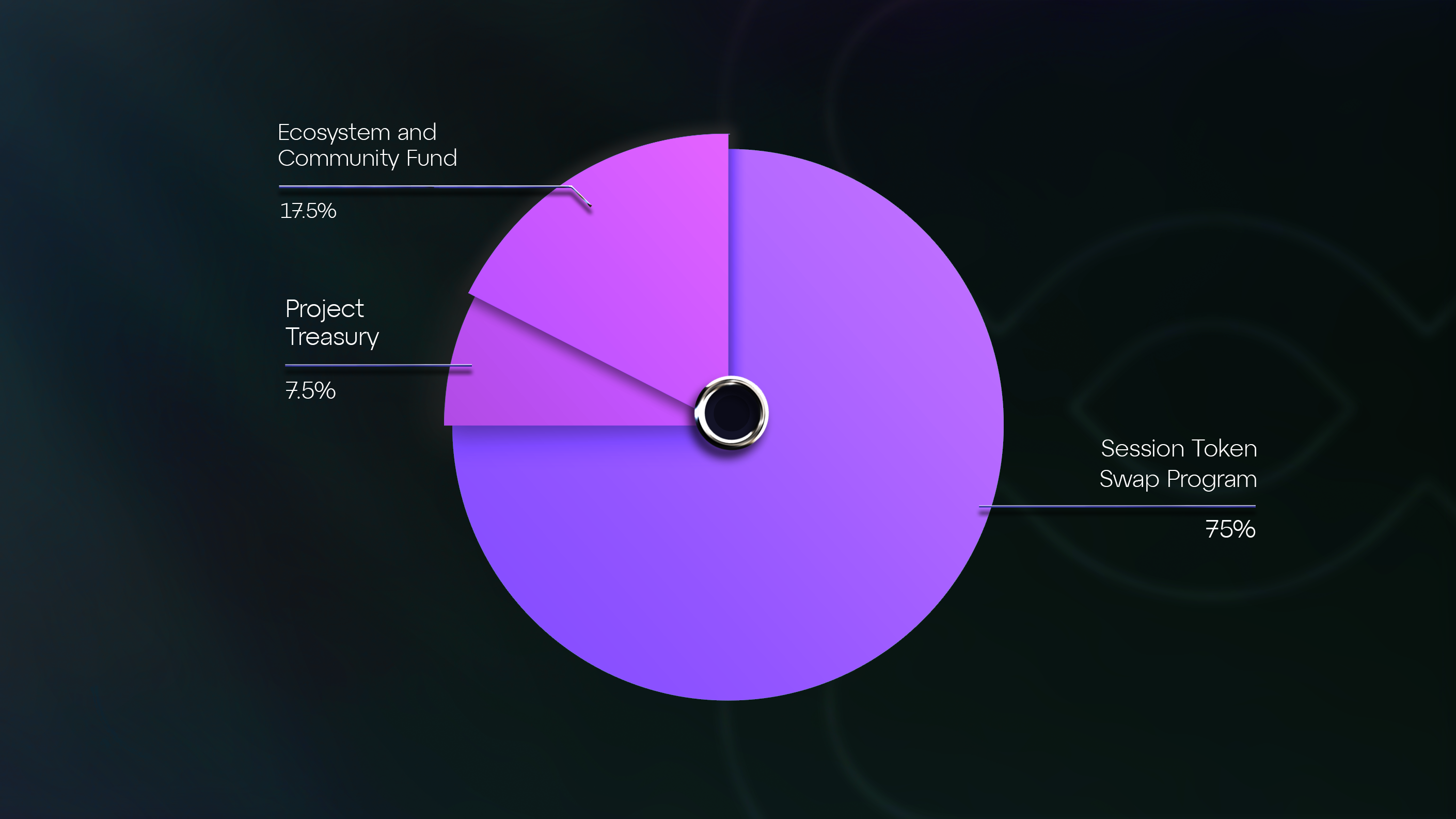

Up to 80 million Session Tokens unlocked at TGE.

- 60 million from Session Token Swap Program (75% TGE supply)

- 6 million for Project Treasury (7.5% TGE supply)

- 14 million for the Ecosystem and Community Fund (17.5% TGE supply)

Varying lock-ups for the remaining 160 million Session Tokens.

The lockups put simply:

- Staking Reward Pool contains 40 million locked tokens at TGE. Network rewards begin unlocking immediately.

- All other tokens are locked for a minimum period of 12 months after TGE. Some can be staked, some cannot (see below).

- If tokens are not sold in the strategic token sale, they will be added to the Staking Reward Pool.

Session Token Lockups

There are a few different types of lockups that can apply to Session Tokens. Overall, up to 80,000,000 Session Tokens will be unlocked at the Token Generation Event (TGE). This leaves 160,000,000 Session Tokens which are subject to some kind of lockup and thus not part of the liquid supply at TGE. These are the different lockup terms that currently exist.

Lockup A: Staked

Tokens are time-locked using a smart contract for 24 months following TGE. Tokens in this smart contract can be staked for participation in the Session Node Network. Rewards earnt through active staking are, as per usual, immediately accessible.

Lockup B: Linear

Tokens are time-locked using a smart contract for 24 months following TGE. Tokens in this smart contract cannot be staked. 12 months following TGE, a 12 month linear unlock begins at a rate of 8.33% claimable per month.

Lockup C: Unlocked

Tokens are distributed at TGE with no associated lockups or restrictions.

Lockup D: Long term commit

Tokens are time-locked using a smart contract for 3 years following TGE. Tokens in this smart contract cannot be staked. 12 months following TGE, a 24 month linear unlock begins (at a rate of 4.16% claimable per month). When these tokens are allocated to any team member, there are performance and operational requirements which must be met before tokens are received.

Lockup E: Staking Reward Pool

Tokens are locked in a smart contract and released at a rate of 14% per year (recalculated per block). The rate of 14% is calculated relative to the total amount of Session Tokens in the Staking Reward Pool, and new Session Tokens may be added to the pool.

What goes where?

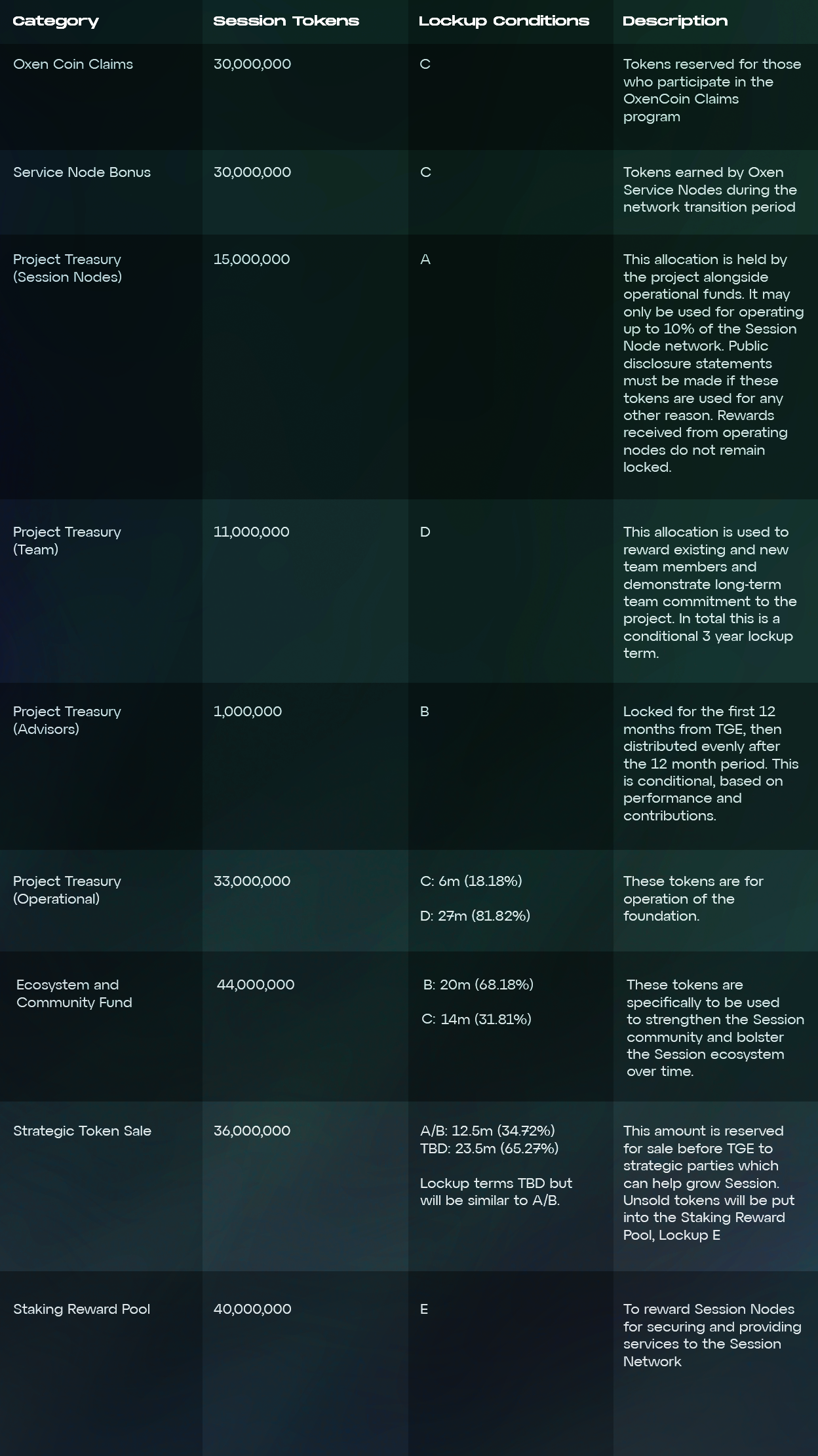

Okay, okay—that’s a lotta different lockups. But which tokens go where? How much is available, and when? Let’s go through and assign a condition to every single allocated Session Token

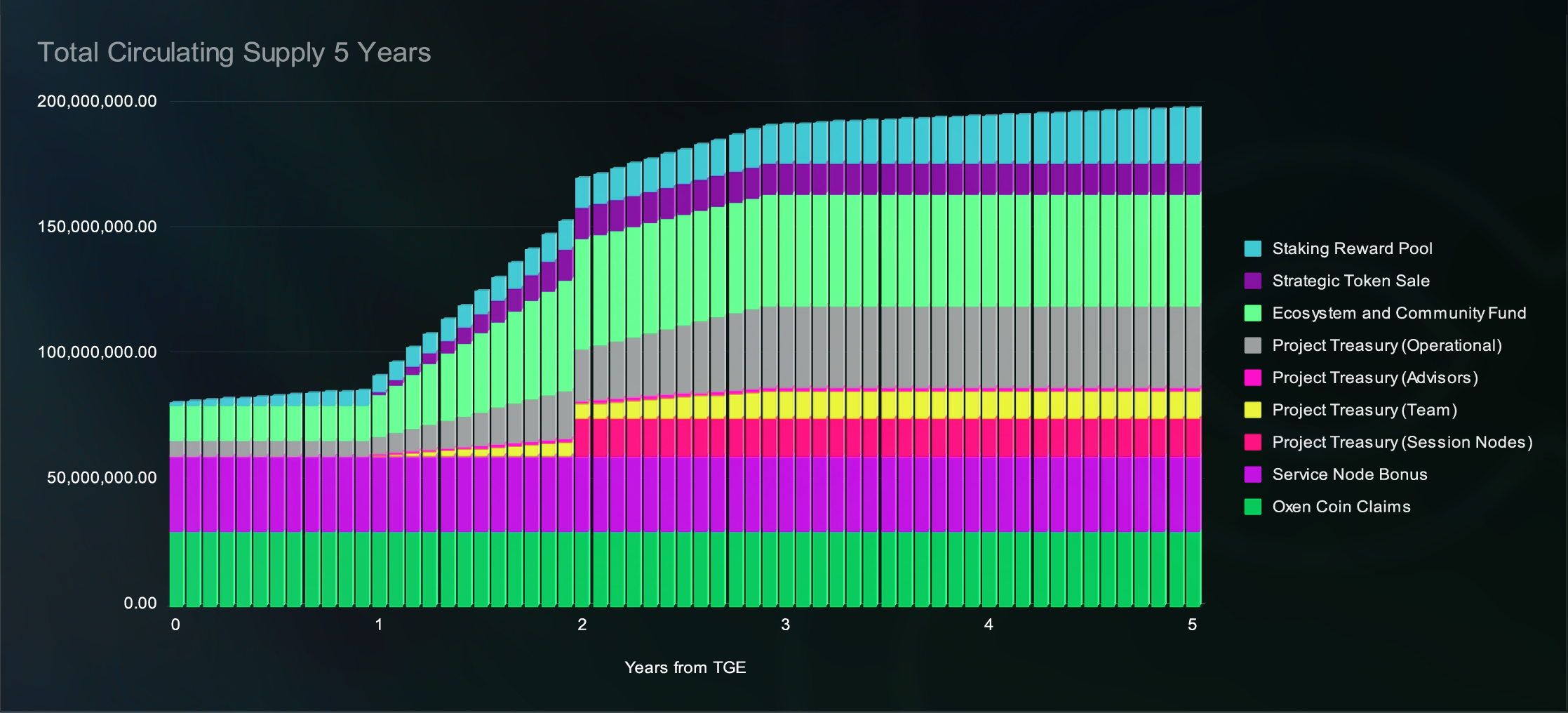

Keep in mind that these are just projections and they are not able to fully account for more dynamic situations where tokens are added to the Staking Reward Pool.

Some notes about this chart:

- This chart assumes that zero Session Tokens are re-minted into the Staking Reward Pool from fees generated by Session Pro, Session Name Service, etc..

- Remaining Strategic sale tokens are not shown, as it is currently unclear whether these funds will even be sold or subject to sale lockup similar to A/B. Whatever is not sold will be allocated to the Staking Reward Pool.

- This chart assumes all currently sold Session tokens will participate in lockup B, in reality strategic parties can choose between lockup A and B before TGE. This chart will be updated once strategic parties decide on their lockup conditions.

- This chart assumes all coins from the Oxen Coin Claim are claimed, it does not reallocate unclaimed coins to the Staking Reward Pool prematurely.

Want an even MORE detailed breakdown? Sure thing, here ya go.

Why does Session Token matter?

Session Token is the backbone of Session's new ecosystem, driving both network security and user engagement. It enables staking to support the Session Network, with rewards flowing back to those who secure the platform.

The token is also key to unlocking premium features through Session Pro and registering unique usernames via the Session Name Service. As users interact with these features, Session Tokens circulate back into the ecosystem, ensuring sustainable growth and long-term value for the community.

Ready to dive deeper into how Session Token works? Check out this post.

Edit: Updated grid under 'What goes where?' for visual appeal on 20 December 2023. Original can be seen here.